An exceptionally rare event during a historic bout of volatility serves as the proverbial light at the end of the tunnel for investors.

When looking back more than a century, you won’t find an asset class that’s delivered a higher average annual return than stocks. But this doesn’t mean the stock market isn’t without its occasional pitfalls.

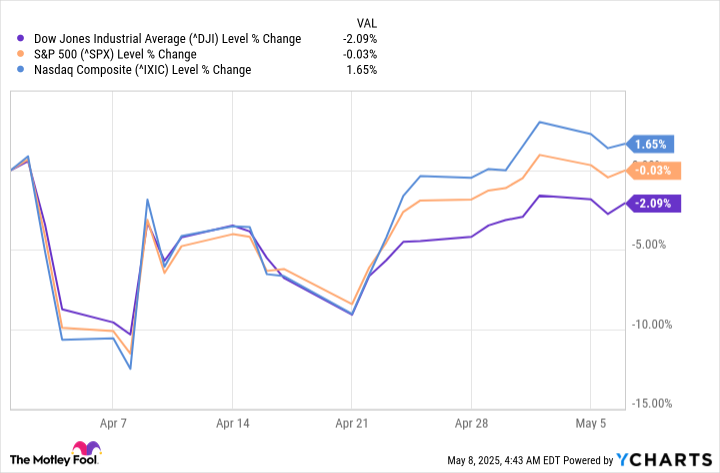

Since the broad-based S&P 500 (^GSPC -0.07%) notched its record-closing high on Feb. 19, we’ve witnessed the iconic Dow Jones Industrial Average (^DJI -0.29%) and S&P 500 both fall into correction territory. Meanwhile, the growth-propelled Nasdaq Composite (^IXIC 0.00%) shed more than 20% of its value and entered its first bear market since 2022.

Image source: Getty Images.

Although stock market corrections and bear markets are normal, healthy, and inevitable aspects of the investing cycle, what happened in April for all three stock indexes was anything but ordinary. We observed the S&P 500 log its fifth-worst two-day decline in 75 years on April 3 and 4, as well as the Dow, S&P 500, and Nasdaq Composite register their largest single-session point increases in their respective histories on April 9.

Volatility of this magnitude is rare on Wall Street — and according to one chief market strategist, the latest round of wild vacillations paints a clear picture of what’s next for stocks.

Four catalysts fueled historic volatility on Wall Street in April

Prior to digging into the correlative data that has a perfect track record of forecasting future stock returns, it’s imperative to understand the four factors that led to April’s historic volatility, as well as recognize that many of these catalysts aren’t going to disappear overnight.

At the top of the list is President Donald Trump’s tariff announcements on April 2 (a day he previously referred to as “Liberation Day”). Trump unveiled his plan to implement a global 10% tariff, as well as higher “reciprocal tariff rates” on dozens of countries that have traditionally run trade deficits with America.

Even though President Trump placed a 90-day pause on reciprocal tariffs for all countries except China on April 9, investors are still clearly worried about the potential for retaliatory tariffs, worsening trade relations, the possibility of anti-American sentiment toward U.S. goods overseas, and the prospect of higher domestic inflation as a result of input tariffs. An “input tariff” is a duty placed on a good used to complete the manufacture of a product in the U.S.

It’s been a wild ride for the Dow Jones, S&P 500, and Nasdaq Composite since the beginning of April. ^DJI data by YCharts.

To build on the previous point, investors are also concerned about the growing prospect of a U.S. recession. The initial read for U.S. gross domestic product (GDP) in the first quarter showed an annualized contraction of 0.3%. While this is considerably better than the Atlanta Fed’s GDPnow model forecast for a decline of 2.5%, it still marks the first time the U.S. economy has shrunk in three years.

A historically expensive stock market is the third catalyst responsible for whipsawing stocks in April. In December, the S&P 500’s Shiller Price-to-Earnings (P/E) Ratio (also referred to as the cyclically adjusted P/E Ratio, or CAPE Ratio), hit its peak of 38.89 during the current bull market cycle. It’s the third-priciest multiple during a continuous bull market when back-tested 154 years.

Widening the lens a bit, it’s also only the sixth time in over 150 years that the Shiller P/E has remained above 30 for at least two months. Though the S&P 500’s Shiller P/E offers no help pinpointing when stock market corrections will begin, it has successfully foreshadowed declines of 20% or greater following the previous five occurrences.

Lastly, a rapid increase in long-dated Treasury bond yields has Wall Street on edge. While higher yields have some income-seeking investors smiling ear to ear, one of the fastest upticks in Treasury bond yields in decades threatens to make borrowing costlier for businesses and consumers. It’s a worrisome development when the U.S. economy is on shaky ground.

Image source: Getty Images.

A rare reversal for the S&P 500 points to a very specific directional move for stocks

With a clearer understanding of why the stock market was breaking single-session point and percentage records in April, let’s return to the historic move made by the S&P 500, which, since 1950, has accurately predicted where stocks will go next 100% of the time.

Double-digit percentage intramonth declines in the S&P 500 aren’t commonplace. But it’s exceptionally rare to see Wall Street’s benchmark index lose more than 10% on a peak-to-trough basis within a month and subsequently bounce back more than 10% from its low by the end of the month.

According to Carson Group’s data-driven chief market strategist Ryan Detrick, who used data aggregated by FactSet from Jan. 1, 1950, to May 1, 2025, there have been seven instances where the S&P 500 lost more than 10% during a month and reversed higher by more than 10% by the end of the month.

As you’ll note in Detrick’s post on social media platform X, virtually all of these instances coincide with periods of outsized uncertainty and panic, such as the COVID-19 pandemic in March 2020, the Great Recession in October-November 2008, the dot-com bubble in July 2002, and the Black Monday Crash during October 1987.

Last month was one of the largest monthly reversals ever.

Down 10% MTD at one point, but up 10% off those lows. Here’s what happens next. pic.twitter.com/bpntiSOAhf

— Ryan Detrick, CMT (@RyanDetrick) May 2, 2025

Following the previous six instances where the S&P 500 lost more than 10%, then rebounded by more than 10% in the same month, it was higher one year later 100% of the time. Yes, six is a small sample size, but it’s nevertheless promising.

What’s even more impressive than the S&P 500 continuing to climb after a breakneck intramonth reversal is the magnitude of its gains one year later. On average, the S&P 500 has returned 22.1% following its previous six double-digit percentage intramonth reversals, which compares to an average annual return of 9.2% for the benchmark S&P 500 since 1950.

To add a bit more color here, keep in mind that no forecasting tool — even those that, thus far, have perfect track records — can guarantee what’s going to happen next. It still remains possible that Wall Street’s benchmark index is lower one year from now.

However, time and perspective can change everything on Wall Street.

For example, an annually updated data set from Crestmont Research, which examines the rolling 20-year total returns (including dividends) of the S&P 500 dating back to the start of the 20th century, showed that every 20-year period (106 in total) would have generated a profit for investors. It doesn’t matter if you bought at a temporary top, invested during a recession or depression, or held through a war or pandemic — you would have made money as long as you remained patient and focused on the long term.

Regardless of what uncertainties the next few months may hold for Wall Street, history couldn’t be clearer that the U.S. economy, as well as the companies that power the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite higher, remain well-positioned for long-term success.