Warren Buffett is often considered the greatest investor of all time. His views on this topic (and related ones) carry significant weight on Wall Street, with investors and analysts alike often hanging on his every word during Berkshire Hathaway‘s (NYSE: BRK.A) (NYSE: BRK.B) legendary annual meetings.

In the latest installment of this much-anticipated event, the Oracle of Omaha said positive things about Tim Cook, the CEO of Apple (AAPL 0.49%), a company whose shares his conglomerate has owned for a while. Let’s see what Buffett had to say and what it means for investors.

Image source: The Motley Fool.

Apple has been a terrific investment for Buffett

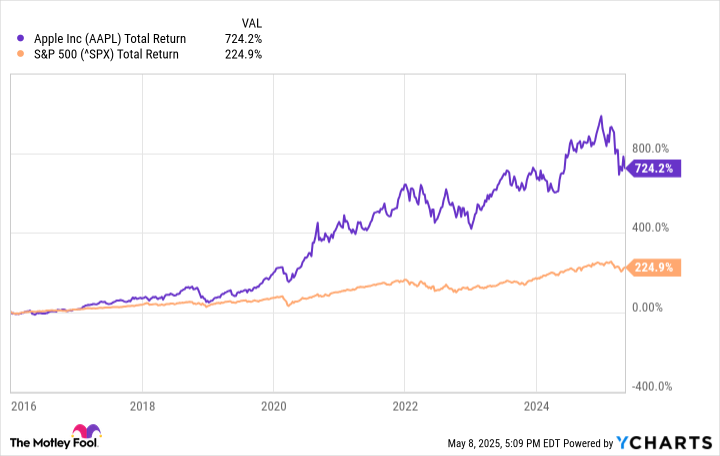

Berkshire Hathaway first purchased Apple shares in the first quarter of 2016. At the time, the tech company was flying high, still riding the wave of its successful attempt to revolutionize the smartphone industry. Buffett and his team clearly didn’t think it was too late to get in on the act, though, and their decision to put money into Apple paid rich dividends, literally and figuratively. Since early 2016, Apple’s stock has delivered market-crushing returns.

AAPL Total Return Level data by YCharts.

That brings us to what Buffett recently said about Tim Cook, who has been the CEO of Apple since 2011. To quote the man himself:

Tim Cook has made Berkshire a lot more money than I’ve ever made [for] Berkshire Hathaway.

Now, let’s remember that Warren Buffett has been at the helm of his company since the 60s, and in that time, the business has performed exceptionally well. Is this statement about Tim Cook meant to be taken literally? Maybe not, but the thing to note here is that Buffett, an excellent CEO in his own right, thinks very highly of Tim Cook.

Here’s something else the Oracle of Omaha said some years ago about the tech company. He called Apple “probably” the best business in the world. Here’s why these comments should matter to investors, especially right now.

Apple can overcome its current obstacles

Apple has faced a barrage of headwinds. Here are three of them. First, the company’s sales growth has slowed considerably since the iPhone no longer generates the buzz it once did. Second, Apple has been the target of antitrust lawsuits due to alleged anticompetitive practices. Third, the tech leader will feel the effect of Trump’s tariffs more than most other companies since it does significant manufacturing in China.

The question for long-term investors is whether Apple can overcome these challenges and still deliver strong performances in the long run. Here’s the connection with Buffett’s recent comments: One of the best predictors of a company’s success is the team leading it. And clearly, Apple has excellent stewardship. Since Tim Cook became the CEO, the company has performed incredibly well. That doesn’t guarantee it can continue doing so. A lot has changed since 2011.

But one thing hasn’t. Tim Cook is still CEO. A leader of this caliber can find ways to navigate the issues the company has encountered. And when looking at the business, we can see signs of a bright future. For one, Apple remains an incredibly popular company with arguably the world’s most valuable brand name. The company’s brand allows it some degree of pricing power, even with stiff competition across all device categories, simply because consumers, at least many of them, want to own one of the tech giant’s devices and are willing to pay a premium for it.

Apple’s installed base of more than 2.35 billion devices recently reached all-time highs across all categories and geographical regions. Further, the company’s services segment continues to make progress. This high-margin unit has grown faster than the rest of Apple’s business in recent years and boasts over a billion paid subscriptions. Apple’s large installed base will allow it to create more monetization schemes.

Lastly, Apple generates significant amounts of cash. Its trailing-12-month free cash flow is $98.5 billion. The company has the financial means to adapt to changing economic situations. It recently announced a $500 billion U.S. investment initiative, partly to shore up its local manufacturing capacity, which will help mitigate the impact of tariffs.

Apple won’t overcome all its issues overnight, but thanks to the strong business it has already built and with an excellent leader at the helm, the stock still looks attractive to long-term investors.