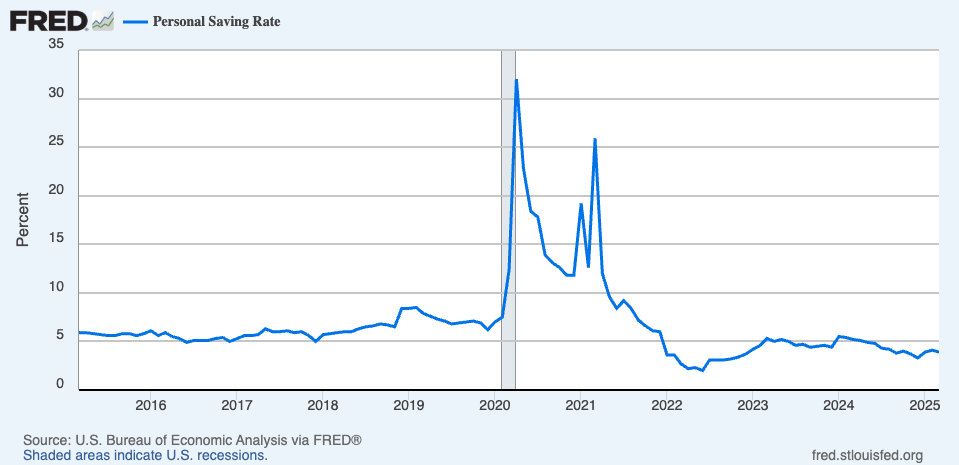

How much of their disposable income are Americans saving?

Answer: 3.9%

Find the most recent data from FRED

Questions:

- Summarize the trends in the personal savings rate over the last 10 years.

- What factors do you think impact the personal savings rate?

- What do you personally think is a good savings rate to aim for?

Click here for the ready-to-go slides for this Question of the Day that you can use in your classroom.

Behind the numbers (Bankrate):

“What a “good” savings rate is depends on your own personal goals and current financial situation. Many experts recommend saving at least 20 percent of your income – in line with the 50/30/20 budgeting model that says 50 percent of your income should go towards necessities, 30 percent on wants and 20 percent to savings – but that’s not always (or sometimes ever) feasible.

According to the Bureau of Economic Analysis, the average savings rate in the U.S. for January 2025 was 4.6 percent. This was an increase from December 2024’s 3.5 percent savings rate. Still, it’s tough for many people to save anything. Almost 3 in 10 (29 percent) of people have some savings, but not enough to cover three months’ expenses, according to Bankrate’s 2025 Emergency Savings Report. And 27 percent of U.S. adults have no emergency savings at all.”