Quick Answer: Lexington Law Firm is the largest credit repair law firm and has a history of success extending over 20 years.

Lexington Law Firm is a credit repair firm that offers services to help you repair your credit if there is information that is inaccurately or unfairly listed on your credit reports.

Lexington Law Firm helps by challenging errors on your behalf (and with your express guidance and permission) with the credit bureaus or with the entities that reported the information, like lenders, credit card issuers and collections agencies.

What Does Lexington Law Firm Do?

The firm’s lawyers and staff are experienced in a wide range of credit repair tasks, and they work to help each client reach a fair and accurate credit report—which will hopefully lead to a higher credit score in the future. Here’s a breakdown of their services:

- Analyze your credit report. The legal team obtains your reports in a manner that doesn’t count as a hard inquiry and won’t impact your score.

- Case Set Up. During the case set up process, you review a list of the negative items listed in your reports, marking anything that looks incorrect.

- Challenges errors for you. Once you’ve chosen the items you want challenged, the team at Lexington Law Firm sends appropriate correspondence to agencies and organizations on your behalf, challenging inaccurate items and requesting they be substantiated or removed from your report. They may reach out to you to ask for any supporting documents. You can track the progress on each item at the Lexington Law Firm website and on their app.

In addition to credit repair services, they also provide some guidance to help clients understand how to proactively protect and increase their credit scores in the future.

Does Lexington Law Firm Actually Work?

For many clients, Lexington Law Firm has worked. Credit repair is a real service and consumers have the legal right to repair their credit as per the Fair Credit Reporting Act.

That being said, there are no guarantees that credit repair will work for everyone. Credit repair is most successful when removing errors – anything that’s unfairly or inaccurately reported, or can’t be substantiated. Credit repair cannot remove items that are accurately reported on your credit.

Watch out for credit repair organizations that make guarantees or claim to be able to remove items from your credit report themselves.

Pros and Cons of Working with Lexington Law Firm

Whether or not you work with a professional credit repair company is a personal decision, so it’s important to weigh the benefits and disadvantages.

Pros

1. Easier Credit Repair Experience

Although you can do repair alone, one of the biggest benefits of working with Lexington Law is that are hiring an experienced team to handle the process for you. Credit repair can be a complex and time-intensive process that requires a lot of communication and follow up with the credit bureaus and other agencies. It’s much easier to hire an agency to handle the process for you.

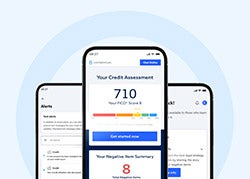

2. User-Friendly App

Lexington Law Firm has a great app that allows you to track the progress on each of the negative items in your case. They also break your credit profile down into the five different categories that FICO uses to create your credit score. As you watch your credit get “cleaned” you can also see where the removal of those items is directly impacting your credit.

3. Customer Service Support

If you have any questions about your case or your account, you can reach out to Lexington Law Firm’s legal advocates via their chat feature on their website and in their online portal. Lexington Law Firm is supportive and has a great record of responding to client questions and explaining complicated credit issues.

Cons

1. Cost: $139.95 per Month

The primary disadvantage of working with Lexington Law Firm to repair your credit is that you do pay for these services. Lexington Law Firm is priced at the higher end of available credit repair services, but we would argue that the cost is worth the quality of the service considering the legal expertise of the firm.

Determining Whether Lexington Law Is Right for You

Only you can make the choice about whether a credit repair service is the right option for you, but if you want help with handling inaccuracies on your report and getting the credit score you deserve, Lexington Law Firm has proven results. It’s a reputable firm that protects your legal rights while following any regulations for credit repair and legal services. If that sounds good to you, consider contacting them today.

Lexington Law Firm FAQ

Is Lexington Law Firm Legit?

Lexington Law Firm is a legitimate credit repair company that has been providing reputable credit repair services since 2004.

How Much Does Lexington Law Cost?

Lexington Law Firm charges $139.95 per month for its services.

Does Lexington Law Firm Have a Phone Number?

Lexington Law Firm does not have a phone number. If you have any questions about signing up or if you are a current client, you can reach them through the chat feature on their website.

Disclosure: Lexington Law Firm advertises on Credit.com and Credit.com may receive compensation if you sign up for credit repair services with Lexington Law Firm. Credit.com is owned by Credit.com Holdings, LLC. Oquirrh Mountain Law Group, PC, d/b/a Lexington Law Firm is an independent law firm that uses Credit.com Holdings, LLC as a provider of business and administrative services.