A record quarter helped shares of EVgo (EVGO 30.33%) surge higher by more than 30% Tuesday morning. That spike came after revenue at the electric vehicle (EV) charger company came in 36% higher year over year.

Its first-quarter results also topped analyst expectations. After installing 180 new charging stalls, the company ended the first quarter with 4,240 operating EV stalls. Investors liked what they heard, sending shares higher by 35.7% as of 11:30 a.m. ET.

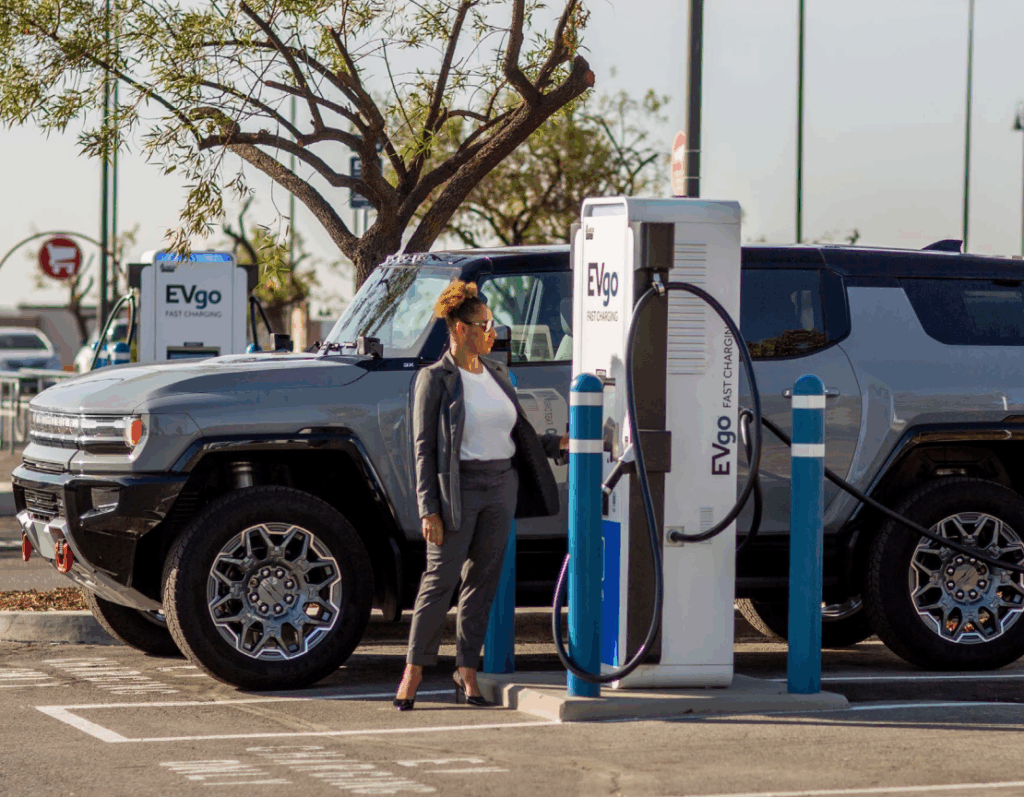

Image source: EVgo.

An uphill battle for EVgo

The company reported an adjusted operating loss of $5.9 million with revenue of $75.3 million. Wall Street analysts were expecting a $6.6 million loss on sales of $71.5 million, according to FactSet Research. Maybe more important for investors, though, was reaffirmed company guidance for up to $10 million in adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) this year. So far, that metric has never been in positive territory for the company.

“We anticipate being minimally impacted by tariffs, and we remain focused on achieving adjusted EBITDA breakeven in 2025 while investing in growth, including our next-generation charging experience,” stated EVgo CEO Badar Khan.

The company is growing strongly despite increasing macro headwinds. EV sales growth rates have slowed in the United States. The Trump administration has also said it plans to end EV subsidies put in place during Joe Biden’s term.

The stock’s massive move in response to EVgo’s quarterly results likely came due to its sharp drop in recent months. Even with today’s jump, EVgo shares have been cut in half over the last six months.

The good news is that operating profit looks attainable despite the ongoing headwinds. If EV adoption does continue to grow, even more slowly, EVgo should reach operating profitability soon. That’s enough for some investors to jump aboard today.

Howard Smith has positions in EVgo. The Motley Fool has positions in and recommends FactSet Research Systems. The Motley Fool has a disclosure policy.