When most people think about budgeting, they imagine a perfect spreadsheet with every dollar accounted for, every category balanced, and zero surprises. But real life isn’t a spreadsheet. It’s messy, unpredictable, and full of curveballs—unexpected medical bills, job changes, surprise school expenses, or just plain burnout.

So, how do you stick to a budget when your life doesn’t look anything like the examples you see online?

You build a plan that expects imperfection and gives you the tools to stay grounded when everything else feels shaky.

As someone who budgeted her way out of $77,000 of debt as a single mom making $30,000 a year, I learned that a good budget isn’t about control—it’s about clarity, stability, and confidence.

Here’s how to create a budget that actually works in the real world:

1. Start With Your Reality—Not Your Ideal

Too many people start budgeting from where they wish their money were, not where it actually is. That leads to frustration and failure.

Before you plan a single category, take a raw, honest look at:

-

What your actual monthly inflow is (from work, side income, support, etc.)

-

Your current spending patterns (not what you hope they are)

-

Debts and obligations you have to pay

-

What’s been catching you off guard (those “unexpected” expenses that happen every single year)

You can’t plan for life if you’re pretending you’re living a different one.

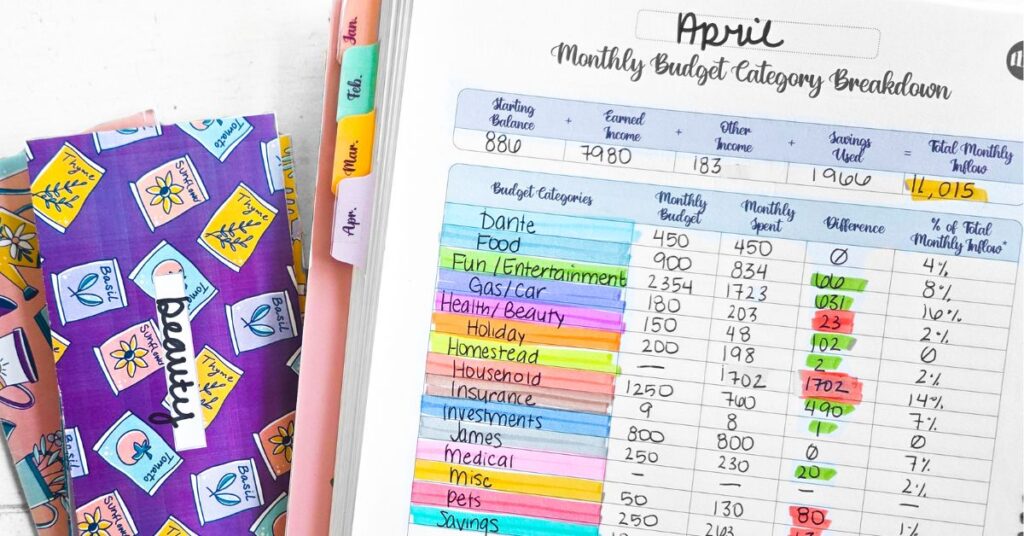

Tip: Print your last full month’s bank and credit card statements. Highlight every transaction and group them into categories. This “highlight method” is the foundation of the Budget by Paycheck Method and it gives you a real-world picture of your spending.

2. Build Flexibility Into Your Budget

One of the biggest reasons budgets fail is because they’re rigid. If your budget is built like a Jenga tower, one small shake will bring the whole thing down.

So let’s budget like we live in the real world:

-

Add buffer categories like a general “miscellaneous” line item.

-

Create sinking funds for recurring but irregular expenses like car maintenance, pet care, back-to-school shopping, and holiday gifts.

-

Avoid over-categorizing from the start—it’s okay to lump things together. Simplifying may help you stay consistent.

Real-life budgeting is more about margin than micromanagement.

3. Make It Personal, Not Perfect

There’s no “right” way to budget. There’s only your way.

Your priorities, your values, your season of life—that’s what your budget should reflect.

-

If you’re in survival mode, focus on a bare-bones budget and protecting your essentials.

-

If you’re rebuilding after hardship, include space for emotional healing—therapy, rest, even small joys.

-

If you’re growing your income, build an investment into your future self, whether that be skills, savings, or business tools.

4. Focus on Pay Periods—Not Just the Month

One of the most common mistakes I see? People try to budget by the calendar month, even though their pay doesn’t align that way.

That’s why I teach people to budget by paycheck. It’s more straightforward, more practical, and actually matches how your money flows.

Here’s how it works:

-

List the bills and expenses due before your next paycheck.

-

Allocate that paycheck’s inflow to cover only those expenses.

-

Repeat the process for each paycheck in the month.

This helps you avoid the “too much month at the end of the money” feeling. It also keeps you from spending next week’s money today.

5. Give Every Dollar a Job (But Let Some Jobs Be Soft)

Yes, every dollar needs a job. That’s how you stay intentional. But not every job needs to be set in stone.

Here’s what I mean:

-

Give dollars a purpose (groceries, gas, debt, etc.)

-

But don’t be afraid to reassign them when things change

Example: You planned $200 for groceries but only spent $150. That leftover $50 isn’t a failure. It’s freedom. You can shift it toward savings, cover a surprise fee, or add it to a sinking fund.

Budgets should move with your life—not fight against it.

6. Track Progress, Not Perfection

Here’s the truth: even after a decade of budgeting, my budget still isn’t perfect. But it works.

Because I track progress, not perfection.

-

Did I stick to my budget 100% this month? No.

-

Did I stay aware, make intentional decisions, and adjust as needed? Absolutely.

Celebrate the wins:

-

You caught a bad spending habit before it got out of control.

-

You were able to cash-flow a repair because of your sinking fund.

-

You said “no” to something that didn’t align with your values.

Those wins matter just as much—if not more—than hitting a perfect number.

7. Adjust As You Go—It’s Not One and Done

A real-world budget is never set in stone. It changes as your life changes.

That’s why closing out your budget and doing a monthly reflection is so important. Ask yourself:

Reflection is where learning—and lasting change—happens.

8. Don’t Ignore the Emotional Side of Money

Sometimes we’re not “bad” at budgeting—we’re carrying unspoken emotions around money.

-

Guilt from how we were raised

-

Shame from past mistakes

-

Fear of never having enough

-

The pressure to look like we have it all together

All of these things show up in our spending. So if your budget keeps breaking, look at what’s really behind it.

You don’t need more discipline—you need more compassion.

And when you budget with both? That’s when real transformation happens.

9. Real Life Requires a Real System

You don’t need a fancy app or a perfect setup. You need a system you can stick with—and that’s why I created the Budget by Paycheck Method.

It’s not just a workbook.

It’s a system that:

-

Starts with your real numbers

-

Works with your actual pay schedule

-

Tracks every dollar and category in one place

-

Gives you room to plan, reflect, and adjust every single month

Because the quality of your financial life is determined far more by the systems you build than by the goals you set.

Final Thoughts

Life isn’t predictable, and your budget doesn’t have to be perfect to work. You just need a plan that’s grounded in reality, built with flexibility, and rooted in your values.

A real-life budget is a living, breathing reflection of who you are and where you want to go. And when it’s done right? It becomes one of the most powerful tools you’ll ever use to create a life of peace, confidence, and freedom.

So give yourself permission to mess up, to try again, and to budget like a real person living a real life.

Because that kind of budgeting? It’s what actually works.