This article is an on-site version of our Unhedged newsletter. Premium subscribers can sign up here to get the newsletter delivered every weekday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Good morning. President Donald Trump’s Middle East tour has already been full of surprises. On Monday, he accepted Qatar’s gift of a plane, despite ethics concerns. And yesterday, he announced a big defence and AI pact with Saudi Arabia, and a surprise end to US sanctions on Syria. Three days to go. How many more surprises are in store?

Unhedged is thrilled to introduce a new team member, Hakyung Kim. Hakyung, a graduate of NYU Stern, is joining us from CNBC, where she covered markets, after stints at The Wall Street Journal and NPR. She already appears likely to join the list of people Rob has hired who turn out to be smarter than he is. Email us: [email protected], [email protected] and [email protected].

CPI inflation

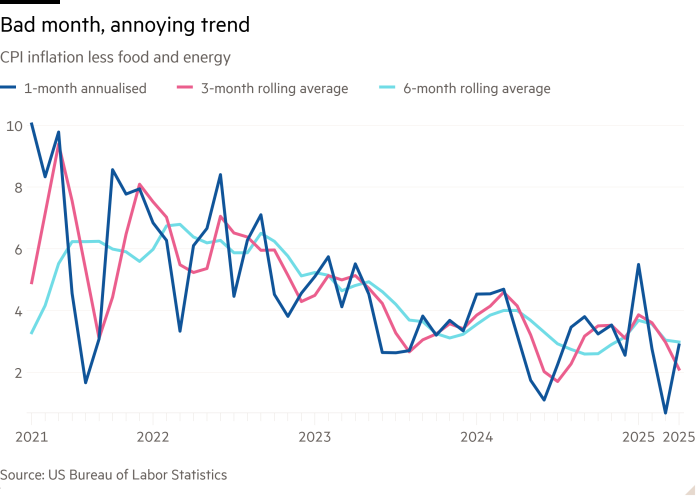

The news was most welcome: headline CPI inflation rose just 2.3 per cent in April from a year before, the lowest since early 2021. But as regular readers will know, that’s not how Unhedged likes to look at it. We like to exclude food and energy and look at the month-to-month change annualised. This is a smoother and more timely reading. And on this basis, inflation picked up a bit this month:

The trend of recent months remains in place: a herky-jerky sideways movement at a level just enough above the Fed’s 2 per cent target to be annoying. A move up in housing prices (a notoriously lumpy series) was a key culprit in keeping prices up this month, but it is not the only factor making the “last mile” of core deflation hard to achieve. Non-housing services inflation, a particular concern for the Fed, is only coming down grudgingly.

No one cares about this right now, though. What they care about is whether Trump’s “reciprocal” tariffs, announced early in April then reduced by fits and starts, have shown up in higher prices. And the answer is: maybe, a little. Several import-heavy categories had a hottish month. Here, for example, are month-over-month changes in furniture prices:

The 1.5 per cent increase between March and April does look a little high. But, again, the data is volatile. It’s hard to say firmly if tariffs were to blame.

That’s not to say that there is nothing to see here. Rather, the nothing is the thing to see. If there was a tariff effect, it wasn’t dramatic, and that’s good news. It shows that retailers did not go in for large price increases in anticipation of incoming tariffs. Next month may be different. But we’ll take reassurance where we can find it.

What to expect from a US default near miss

Treasury secretary Scott Bessent has encouraged Congress to reach a deal to raise or suspend the US’s debt limit by mid-July. If that doesn’t happen, the Treasury will need to take extraordinary measures to avoid missing a debt payment by as soon as August. We expect that Congress will reach some solution before the “X-date”; the consequences of failure are simply too great. But as the days tick by, a “near miss” — Congress raising the debt ceiling just days or hours before the Treasury runs out of money — becomes more likely, and a terrible mistake becomes conceivable.

How might the market start to act if negotiations drag on as the X-date approaches? Looking at recent notable near misses — 2011, 2013 and 2023 — provides clues.

Credit default swaps: Credit default swaps on Treasuries, a direct hedge against the possibility of a US sovereign default, are the most responsive to the US’s budget situation. The cost of a 1-year credit default swap on a Treasury rose substantially in 2011, 2013 and 2023:

The CDS price is now around the levels of 2011 and 2013. Yet, the price went way higher in 2023. It’s not clear why, but there are at least three candidate explanations. It could be that the market has become more aware of the risks after experiencing multiple near misses in the 2010s and as conversations about the US deficit have become more urgent. Or it could be because in 2023 the Fed was shrinking its balance sheet (quantitative tightening) rather than expanding it (quantitative easing). Or it could simply be because the US debt was much higher, both in absolute terms and as a percentage of GDP, in 2023 than in 2011 and 2013:

All those dynamics are currently at play, to varying degrees. CDS prices could rise quite a bit further from here.

Equities: In 2013 and 2023, the market went down slightly before a deal was reached and got a small bump afterward. It is unclear if the looming X-date was the cause, but according to Goldman Sachs and the Bipartisan Policy Center, companies with high exposure to government spending, such as infrastructure and defence groups, noticeably underperformed the market in the run-up. Chart courtesy of the Bipartisan Policy Center:

2011 saw a much bigger equity response. In the weeks before and after the X-date — which Congress beat by only two days — the market dropped 17 per cent, the largest correction since the financial crisis just three years earlier:

Why things were different in 2011 and why the market continued to fall after the agreement was reached is, again, not perfectly clear. It was the first near miss after the great financial crisis and a US default seemed like more of a real possibility. The US economy was wobbly and the Eurozone was under strain, too. And right after the incident, Standard and Poor’s downgraded the US’s credit rating from AAA to AA+, even though the budget was already signed. That the US came through the mess in one piece may have made equity investors less sensitive when Congress next crept up to the edge.

Treasuries: Treasuries show a more durable trend: yields on the absolute shortest duration Treasuries jump, while moves in longer-term Treasuries are muted. From Shai Akabas at the Bipartisan Policy Center:

What we have seen clearly in past episodes is that there is an increase in the rate or reduction in the price of securities that are maturing shortly after the projected X date, because investors are concerned about holding securities [that could go unpaid soon] . . . We have not seen a significant movement in longer term rates that can be easily attributed to the debt limit.

2023 is a good illustration. One-month yields (the dark blue line below) leapt, the 3-month and 2-year yields crept up, while longer tenors were mostly indifferent:

Akabas notes that longer-dated Treasuries might not react in part because default still seems quite unlikely. But that would probably change quickly were the US government to miss a payment.

Together, past near misses suggest we might see a big jump in CDS prices and T-bill yields, and downward pressure on the S&P 500 this summer, especially if Trump’s “big beautiful” tax bill hits roadblocks. But note that 2025 is very different from 2011, 2013 and 2023. In all three earlier instances, Republicans had control of at least one chamber of Congress and were battling with a Democratic presidential administration over spending cuts or freezes. Things are harder to read this time. Republicans have control over the House, Senate and the presidency, but there are spending disagreements within the caucus, surprising policy proposals emanating from the president and a Democratic party that is missing in action. The probability of a near miss, or worse, is harder to read.

Investors are facing a messier debt and economic picture, too. Debt and debt interest payments are higher than in the past three episodes. The economy is trickier to analyse because of tariff uncertainty. And foreign demand for Treasuries is questionable at the margin.

That markets, particularly equity markets, were generally calm around past near misses suggests broad trust in the US as a creditor and Congress as a responsible actor. But that could be changing. “Institutional concerns about the US government are higher than at any point in the modern era . . . Congress may not be able to control the market’s fear” said Alexander Arnon, director of policy analysis at the Penn Wharton Budget Model. We hope it isn’t so.

(Reiter)

One good read

Everyone’s a winner.

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.