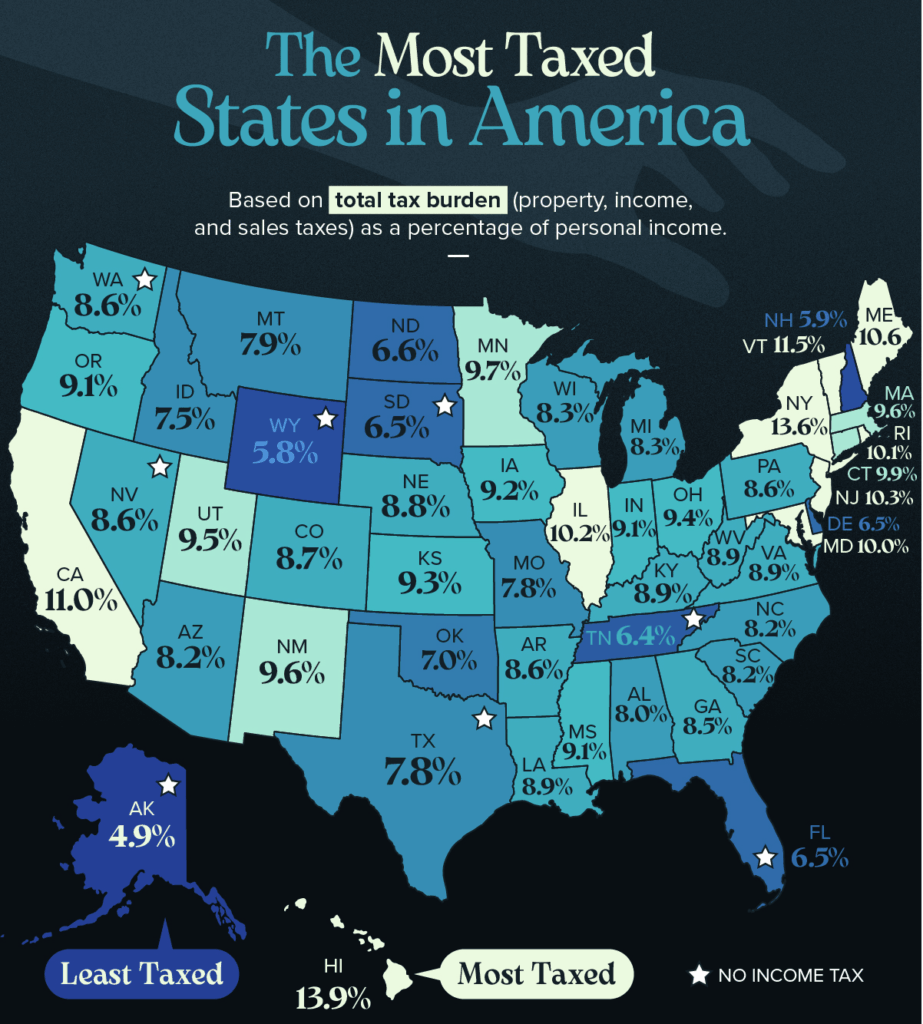

When you think of taxes, you probably think of federal income taxes first. But state taxes can add up!

Answer:

Most taxed: Hawaii at 13.9%

Least taxed: Alaska at 4.9%

Questions:

- How does your state compare? What is your state tax rate?

- How much would you consider state taxes when deciding where to live? Why?

- What programs/services are funded with state taxes?

Here are the ready-to-go slides for this Question of the Day you can use in your classroom.

Behind the numbers (Visual Capitalist):

“Hawaii holds the highest total tax burden in the United States, with residents contributing nearly 14% of their income to state and local governments. This includes 4.2% in income taxes, 2.6% in property taxes, and a substantial 7.2% in sales and excise taxes.

In contrast, Alaska has the lowest overall tax burden. Residents there pay no state income tax, only 3.5% of their income in property taxes, and just 1.5% in sales and excise taxes—resulting in a total tax burden of only 4.9%.”

About

the Author

Kathryn Dawson

Kathryn (she/her) is excited to join the NGPF team after 9 years of experience in education as a mentor, tutor, and special education teacher. She is a graduate of Cornell University with a degree in policy analysis and management and has a master’s degree in education from Brooklyn College. Kathryn is looking forward to bringing her passion for accessibility and educational justice into curriculum design at NGPF. During her free time, Kathryn loves embarking on cooking projects, walking around her Seattle neighborhood with her dog, or lounging in a hammock with a book.