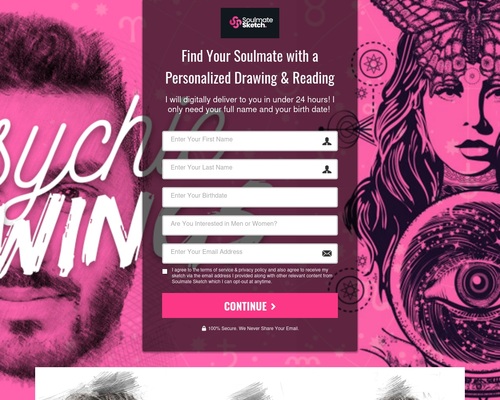

Product Name: Find Your Soulmate Sketch

Click here to get Find Your Soulmate Sketch at discounted price while it’s still available…

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Find Your Soulmate Sketch is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.

Description:

Click here to get Find Your Soulmate Sketch at discounted price while it’s still available…

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.

Find Your Soulmate Sketch is backed with a 60 Day No Questions Asked Money Back Guarantee. If within the first 60 days of receipt you are not satisfied with Wake Up Lean™, you can request a refund by sending an email to the address given inside the product and we will immediately refund your entire purchase price, with no questions asked.